We will seize the business opportunities offered by the global energy transition.

Boralex offers growth, dividend returns and long-term value creation

- Unique positioning and acknowledged expertise

- Company growth

- Well-defined strategic plan and financial objectives in an industry with robust potential

- Disciplined financial management and strong financial position

Our strength lies in the expertise, skills and ingenuity of our employees. We’re committed to carrying out our strategic plan:

- By acting ethically

- By being a model corporate citizen

- By giving back to communities

- By offering sustained financial performance to shareholders and partners

Unique positioning and acknowledged expertise

-

2,492 MW of highly diversified production capacity as of February 23, 2022

Expertise in developing small and mid-sized projects

Company Growth

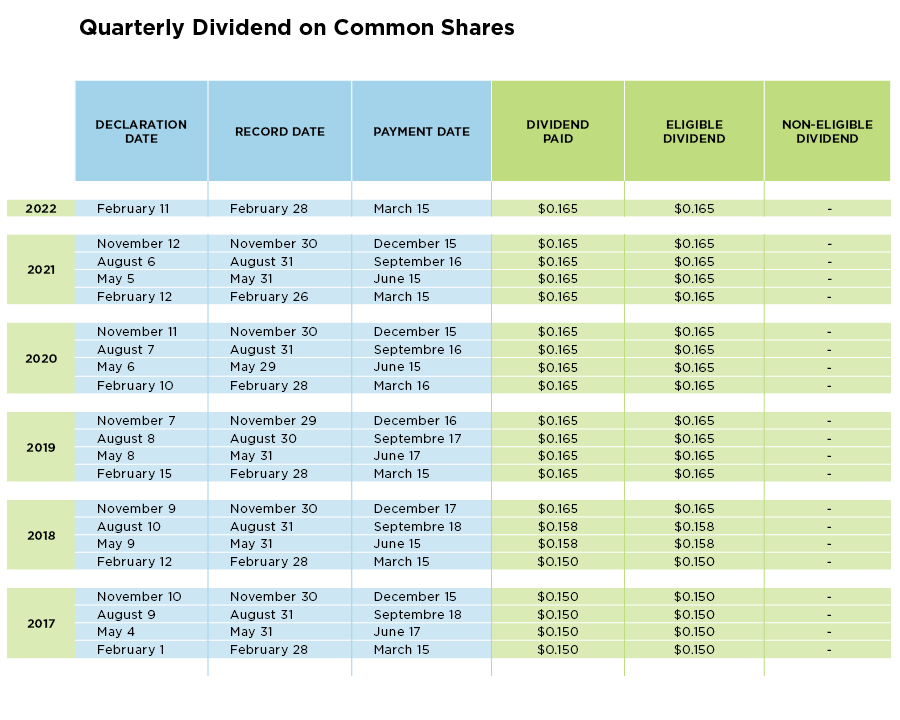

- Sustained increase in dividends since their introduction in 2014

Well-defined strategic plan and corporate objectives in an industry with robust potential

- 4 strategic orientations: growth, diversification, customer base and optimization

- 6 corporate objectives

- 10 ESG priority issues

- Project portfolio of 3,144 MW of energy production capacity and 193 MW of energy storage capacity

Disciplined financial management and strong financial position

- Major cash flows from long-term contracts

- Strong balance sheet and the financial flexibility to support growth

- Limited exposure to interest rate fluctuations with fixed long-term rates timed to contract maturity

- Exchange rates hedged with forward contracts for France

Invest in a company with a solid ESG strategy

The markets are clear: the carbon footprint of a portfolio is increasingly important to investors. That’s why we have built a corporate social responsibility (CSR) strategy based on transparency and strong governance, and why our approach is based on the priorities of our internal and external stakeholders, including our investors and financial analysts.

ESG: Our actions, our commitments and our approach

Our growth strategy is tied directly to our Environmental, Social and Governance actions. In fact, we have raised our CSR objectives to the same level as our financial objectives in our updated Strategic Plan for 2025.

Investing in Boralex means participating in the growth of a renewable energy company that goes far beyond its industry in terms of sustainable development.

In November 2021, Boralex announced the renewal and extension of its corporate credit facility and letter of credit facility for $525 million, for a remaining term of five years, with sustainable financing features (ESG criteria) and $150 million under an accordion clause. The terms of the facility provide for a reduction or increase in borrowing costs depending on whether we achieve our targets for avoided CO2 emissions and representation of women in management positions. Our 2025 targets in that regard are:

- 27.5% of management positions held by women

- 781,773 tons of CO2 avoided through our renewable energy production

We have also updated our sustainable procurement charter to clarify our CSR expectations for our suppliers. We have set targets for parity at all levels of the company, whether on the Board of Directors, among managers or for future hires.

Strong CSR governance

- Boralex’s CSR leaders also worked to establish strong governance that would ensure the success of our strategy in the three categories of ESG criteria. Among the solutions implemented:

- Amendment of the Nominating and Corporate Governance Committee’s mandate to include oversight of the CSR strategy progress.

- Updated senior executives’ variable compensation to add occupational health and safety performance target

- Hired a CSR Director as a CEO direct report

- Established an internal committee to oversee the implementation of the 11 recommendations of the TCFD

- Numerous third party disclosures

Our Executive Committee and Board of Directors

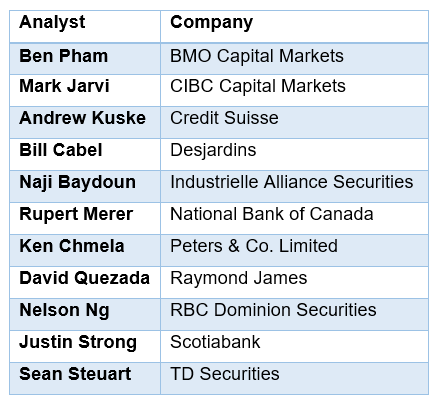

Financial analysts

Financial coverage of Boralex

Last update: February 2021

The above list is strictly informative. The opinions, estimates or forecasts provided by these analysts with respect to Boralex’s performance are their own and do not represent those of either Boralex or its management.